Abandon Your Current Direct Deposit: Why and How to Make a Change

Paper payroll checks are the dinosaurs of the 21st century, but here's where it gets interesting: not all direct deposits are created equal!

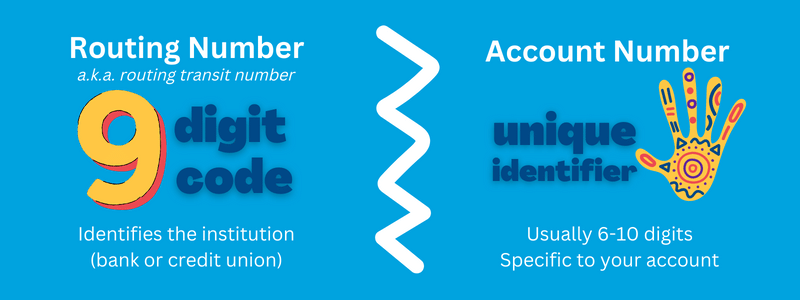

Direct deposit is when an employer pays an employee via ACH (automated clearing house) electronic transfer and the money lands directly in the employee's account; no paper check involved. The employee provides a routing number and account number to their employer in order to make this happen.

Chances are, you set up your direct deposit when you started working for your current employer. Things may or may not have changed since then, so take a moment to consider the reasons to abandon your current direct deposit situation. Or if you haven't set up direct deposit, reasons to start.

Reasons To Switch (or Start) Your Direct Deposit

-3.png?width=792&name=Untitled%20design%20(9)-3.png)

1. Your current account charges monthly maintenance fees

It's just not necessary to pay monthly maintenance fees when there are affordable credit union checking accounts out there. No minimum deposit required, just enroll in eStatements and enjoy low cost checking. The average monthly maintenance fee in 2022 is $9 per month at a bank. That's almost $100 saved over the course of a year by switching your direct deposit to a credit union checking account.

2. Your paycheck is being deposited on time 😏

With us, you get paid early. We post direct deposits as soon as possible (depending on the settlement date of the payment file from the payer). Most financial institutions hold onto your hard-earned cash an extra 1-2 days.

3. You're not saving

The moment the money lands in your account (ours hits every other Wednesday) you can set up an automatic transfer of $50 -or more, or less- to go from your checking account to your savings account. That way, you've paid yourself first before your bills (or the temptation to spend) comes calling.

4. You're using a prepaid card to receive compensation from work

Although prepaid cards seem like a convenient option, there are drawbacks.

Prepaids are similar to having a debit card, just without an account or institution in the background doing the heavy lifting.

They're more susceptible to fraud, and can be lost or stolen. Also tending to be subject to card "freezes" for places like gas stations and hotels, you may not be able to use those funds for 1-2 weeks or more while the hold/freeze is active.

They also usually come with fees (for the employee) and severely limit your flexibility to move money around and save up for your future.

How To Make A Direct Deposit Change

You will likely only need 2 pieces of information to make a direct deposit change:

1. Bank or Credit Union Routing Number (9 digits)

- Find it on a recent monthly statement

- Find it on our website (scroll to the bottom of any page, it's on the left 😘)

2. Bank or Credit Union Account Number (ours is 10-11 digits, other institutions vary)

- Find it on a recent monthly statement

- Log in to online banking or the mobile app and choose the "Account Details" tab when viewing your checking account

There may be a direct deposit form you need to fill out and give to your employer, or you might be able to complete the change digitally via your employee's payroll portal in a minute or two.

The only other thing to consider when moving your direct deposit is whether you have any automatic payments coming out of the old account. If you did, you'll have to update the payment method if you don't plan on keeping a lot of money in there.

So - if you haven't looked at your direct deposit situation in a while, it might be a good time to do so! Check your current provider against our tips above, and let us know if you want to make a change. 😜

And if you're good on the direct deposit front but want to make moves towards getting your financial future in order, you might want to check out our budget plan eBook!

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.

.gif?width=258&name=Untitled%20(800%20%C3%97%20300%20px).gif)