-2.png?width=590&height=530&name=Untitled%20design%20(55)-2.png)

Whitney, Employee

This eBook is a fantastic way for anyone to get their finances on track. It’s easy to follow and doesn’t make you feel ashamed if you are a spender and not a saver.

Table of Contents

-

Introduction

-

Chapter 1: Zero Balance Budget Defined

-

Chapter 2: Finding Your Financial Why

-

Chapter 3: Gather Documents You'll Need

-

Chapter 4: Net Income Totals

-

Chapter 5: Expenses Into Categories

-

Chapter 6: Find the Difference

-

Chapter 7: How to Make Adjustments

-

Chapter 8: A Case Study - Rubio & Alice

Send a copy to your inbox now:

Ultimate Budget Plan to Save Your Time and Free Your Money

Introduction

If you feel like you never seem to get ahead financially, or don’t know where all your money is going, it’s time to learn how to make a budget plan that works for you.

But you’ve heard this before, right? Maybe you’ve tried a monthly budget planner or used a budget template that was supposed to make your finances fall into order. 90% of Americans say that everyone should have a budget, but only 30% of us do. Problems with eliminating debt or building up savings are all too common. Across all income levels, people struggle to get ahead in their financial lives. Knowing your financial health score and how it compares to other Americans can be a helpful first step before you start your budget plan. It really gives some perspective!

Now that you're ready, how do you make a monthly budget plan that works? An increasing number of people are employing a strategy called Zero Balance Budgeting, which gives all of your money a ‘job’ to do. Skip down to Chapter 1 if you’re ready to learn more.

If you’re a student in college, your situation is a bit different. We have a budget template for you specifically that could be a great first step.

Chapter 1: What is a Zero Balance Budget Plan?

Also called a “zero-sum” or “zero-based” monthly budget, the premise is to be aware of every dollar of income, and then tell it where to go. At the end of the month, each dollar has gone somewhere to do its job.

No, this doesn’t mean you spend every dollar you have every month.

No, you don’t save every dollar you have either.

And no, it doesn’t mean you make someone else manage your money for you. 😂

The shortest explanation is this: you’ll list all of your bills, spending needs, savings goals, and debt payments, then make every dollar of your income do one of these jobs! At the end of the month, the goal is to have exhausted all of the monthly revenue you took home – or – be back to a ‘zero balance.’ We also have a plan for you to have some buffer funds in your checking account in case of a miscalculation, so don’t worry, your balance won’t ACTUALLY be zero (because that makes us nervous too).

Helpful Tip: It’s important to have a credit union checking account that doesn’t hit you with a fee for having a low balance! Affordable accounts do exist.

In a Zero Balance Budget Plan, here are some of the ‘jobs’ your money does for you:

• paying mortgages or rent

• buying groceries

• making auto loan payments

• making credit card payments

• filling up on fuel

• contributing to retirement accounts

• bulking up emergency savings

• spending on fun stuff*

*Fun stuff? Yes! You can still have money to spend on your favorite pizza place or on that new pair of shoes you’ve had your eye on. There’s no point in having a budget that allows for zero fun. Nobody wants that AND it’s not sustainable. Just like that juice cleanse...

Zero balance budgeting makes your income work for you. Instead of just taking care of bills and spending the rest of your paycheck mindlessly, you’ll be working towards your financial goals. Game. Changer. Are you ready?

Chapter 2: Goals! Find Your Why

Have you seen those beautiful vision boards on Pinterest where people cut & paste pictures of their hopes and dreams on a big poster board and then decorate it? Don’t worry, we won’t make you do that. 😅

But the process of creating a monthly budget plan does take some visualization and goal-setting in order to be effective. Take a moment and consider the lifestyle you are currently leading. Where do you live, work, & play? What do you do with your free time? What stresses you out financially? Close your eyes and think about this for a moment. [No, really, just pause for one moment and do it.]

Did you know that visualizing your goals can actually change your reality? A study showed up to 30% increase in muscle strength when individuals simply thought about doing strengthening exercises.

Knowing the power of visualization, now picture your desired lifestyle. Is it different than your current reality? What are some of your dreams and goals for the future?

.png?width=971&name=Budgeting%20Life%20Goals%20%20(2).png)

Don’t just say something like ‘pay off debt’ because yes, although that is important, right now we’re focusing on your dreams and aspirations. Think big!

If you are like most people, there are probably areas that you’d improve if you could. Choose three of the visualizations for your desired lifestyle and future goals/dreams. Write them down! If you download the printable copy of this eBook, we'll include a worksheet for you to jot down your goals in one place.

If you’re in a committed relationship and you share finances with your partner, it may be worth it to go through this step together. We have a family finance support series of articles discussing all things money for you to check out as well:

1. Family Finance Support: Newlywed & Courageous Thinking Ahead

2. Family Finance Support: On Kids & New Ways to Start Quality Money Conversations

3. Family Finance Support: Avoid This One Thing When Talking Money With Your Partner

Once you have your goals on paper, you’re ready to prepare for your monthly budget plan.

Chapter 3: Intake Time! Gather Financial Documents Before Starting Your Budget Plan

The first step to an improved financial life is knowing how much money you make and where that money is going right now. In order to track spending, it helps if you have the following documents.

One month’s worth of:

• Bank statements - electronic statements work well - or log in to online banking and view transaction history for all active accounts

• Pay Stubs and/or 1099 Forms

• Credit Card Spending Reports & Statements

• Proof of Income Letter (if receiving Social Security benefits)

• Tips or commissions totals

• Unemployment Income – Award Notice

If you download the printable PDF of this eBook, there’s a workbook-style page in this section that you can use to easily categorize your spending with definitions and examples, so that you can see where certain items go.

The nice thing about going directly to your financial institution (using eStatements or online banking) is you can usually view and sort your transaction history as needed for a particular purpose. More to come on this in following steps.

Chapter 4: Get Paid! Add Up Net Income

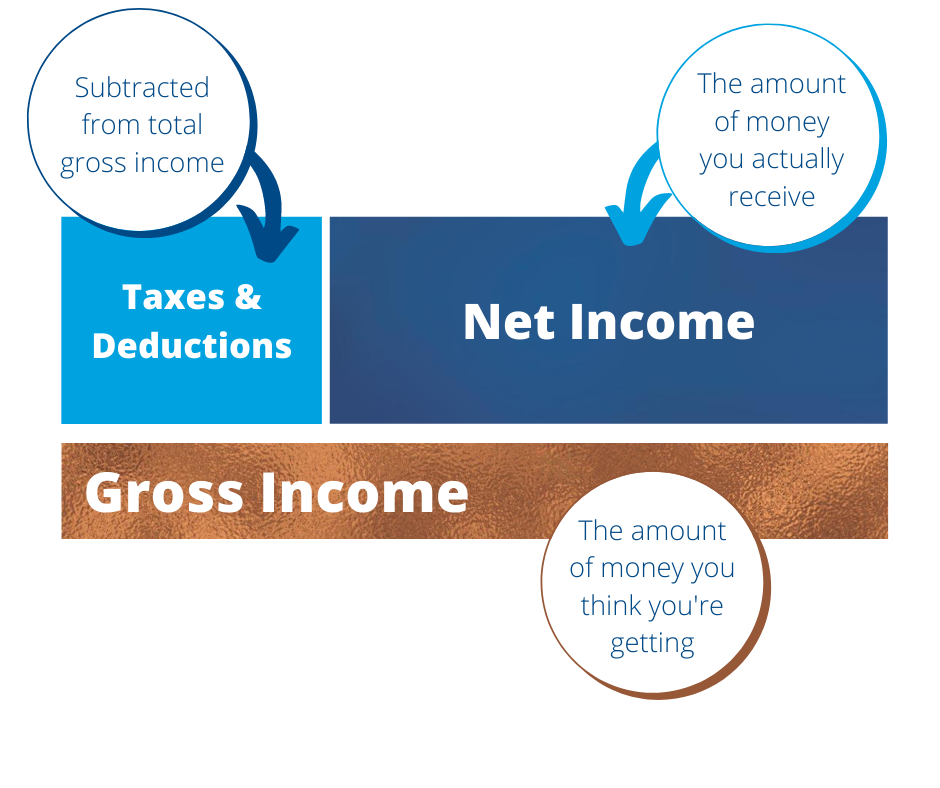

What is Net Income & How to Calculate Net Income

Net income is take-home pay or the amount of money you get to keep after deductions and/or taxes are removed from the gross amount. Always use net income rather than gross income when making a household budget plan. The difference between the two is illustrated in the graphic below:

Examples of taxes and deductions: Federal Income Tax, FICA (Social Security + Medicare), State Tax, Local Tax, Medical Insurance Premiums, 401k contributions, HSA or FSA contributions, Life Insurance Premium, Dental Insurance Premium and Child support/alimony, among others.

Income Categories: Regular or Irregular?

Which type of income do you have? Both regular and irregular income still equate to money in the bank, so both are great! They’re just different.

If you make about the same amount of money each pay period, you are a recipient of regular income.

If the amount you make varies significantly because of tips, commissions, hourly differences, multiple side-hustles, etc. then you are making irregular income. Tips for both groups are below!

Regular Income Household

If your household incomes are regular, adding up your income is pretty simple. Take a look at the income-related direct deposits you got into your checking account during a recent month, and add them up. This is where your bank statements or online banking transaction history comes in super handy. Many people have two paychecks/direct deposits per month (bi-weekly) but yours may be different! Find all income for the calendar month for all earners in the household who contribute to household expenses. You can also find this information on recent paystubs.

What counts as income?

To answer the question I know someone is asking: no, your winnings from betting your friend he couldn’t eat 10 hotdogs does not count as income. Neither does the mail-in rebate you got for your recent vitamin purchase! Your scratch-off lottery ticket winnings don’t count either, unless you’re suddenly a millionaire – in which case, let’s talk…

But everything else that involves money coming in is considered income. Think paychecks, side hustle gigs, alimony/child support, social security payments, etc.

Irregular Income Household

If you have one or more incomes that vary from month to month, listen up. You have two options:

1. Use the lowest total monthly income from the last 12 months

2. Use the average monthly income from the last 3-6 months

The first option is more conservative because it builds your budget off of the (likely) lowest income you’ll have. Then, it will reward you with extra dollars to allocate if you make more than that.

The second option is probably a higher monthly number, which makes it easier to meet all your budgeting goals. However, you’ll have to ensure you have a buffer amount sitting ready in case you make less than the average in any given month.

Once you’ve decided your approach, use the same tactic as a regular income household and add up income from either bank statements or paystubs/receipts. And if you’re more of a ‘baby steps’ person, try out our 10-day budget organizer challenge.

My Monthly Net Income: ________________________

Chapter 5: Add Up Budget Plan Expenses in Categories

Knowing your expenses is more than just arriving at a total. The zero balance budget approach allows you to analyze the information and then challenges you to spend every dollar intentionally.

Where to find your expenses? Grab the bank statements and credit card statements from step 3. What payment method do you use to pay for things like groceries, pizza delivery, etc.? Make sure you’re checking all of these sources for one month's time to get a good idea of your expenditures across the board.

1. Bills

This group includes anything you must pay in order to have your needs met.

Dave Ramsey coined the idea of the “Four Walls” – Food, Utilities, Shelter, Transportation, to be prioritized and paid in that order. Other debt payments that are due monthly would also go into this category. Examples of bills to include when adding up this section:

- Groceries

- Electric/Gas and Water/Trash Utilities

- Mortgage or Rent

- Auto Loan payment and insurance

- Gasoline costs or public transportation fees

- Debt payments due

2. Savings

Are you putting any money towards savings accounts on a regular basis? Record the total dollar amount you’re saving on a monthly basis from your net income. Find out more about how to create an effective savings plan here. Or, check out the 3 Best Savings Account Types Every Arizonan Should Have.

3. Spending

This category includes other areas you regularly spend your money on, such as clothing, dining out, vacations, entertainment, pets, etc. There's no easy way to calculate this besides going into your credit card or checking account statements and looking at the spending for a prior month. Otherwise, we tend to wildly underestimate our own spending in this category.

My Monthly Expenses Total: ________________________

Chapter 6: Subtract Expenses from Income in Your Budget Plan

Take your totals from Chapter 4 and 5 to complete the calculations below.

• If your Net Income – Monthly Expenses = Zero

If you added up all your expenses (bills + saving + spending) and subtracted it from your income, maybe everything zeroed out! When that’s the case, you’re 80% of the way there. All of your income has a purpose and the only work you have left is to adjust it to meet your goals. Move on to Chapter 7 of the budget plan.

• If your Net Income – Monthly Expenses = Greater than Zero

This just means that you’ve got some money left over at the end of the month and you can put it to work. This amount will be given a new job in your monthly budget!

Let’s say your income, for simplicity’s sake, is $1000 per month.

- All bills: $600

- All spending: $300

- Savings: $0

When you subtract bills, spending, and saving (expenses) from your net income, you still have $100 left over – SCORE! In the next chapter, we’ll work on giving this money a job within your budget plan and analyzing whether your money is going where you want it to go.

• If your Net Income – Monthly Expenses = Less than Zero (Negative Number)

This means you’re currently spending more than you make. Not to worry, we’ll address ways to tackle this! The first step is just knowing that it's happening. (Congratulations!) You'll be on your way to great financial health in no time.

Chapter 7: How to Make Monthly Budget Plan Adjustments

One of the primary goals of this monthly budget planner is to assign a measurable task or job for every penny that comes in and goes out. Some folks subscribe to a basic 50/30/20 rule, where 50% goes towards bills, 30% towards spending, and 20% towards different types of savings. But we realize that everyone has different goals and different needs, so don’t get hung up on meeting these numbers.

Take the time to review your current net income and those three categories of expenses – bills, spending, savings.

Ask yourself some questions, like:

• Do these numbers fit my quality of life expectations?

• Does my current budget plan deliver long-term financial success?

• Am I saving enough for the things I want in the future?

• Am I slipping into debt?

• Where am I willing or able to make changes? (For example, saving money at the grocery store)

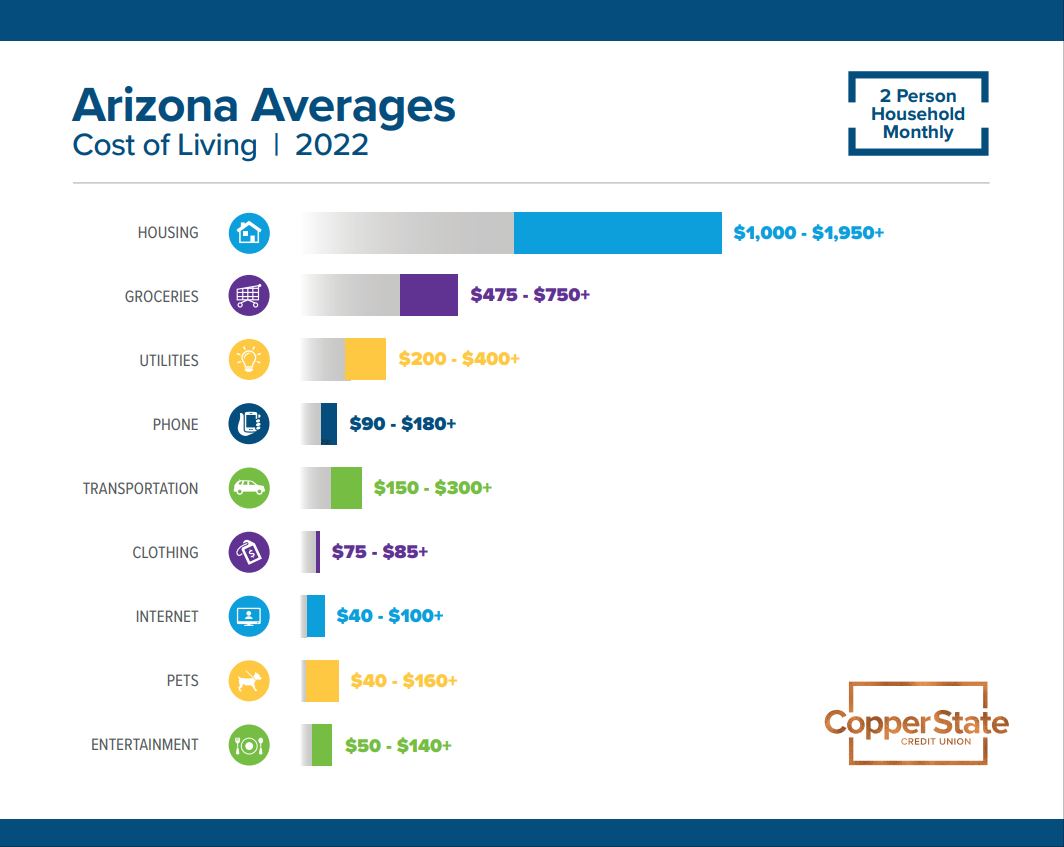

Another question to ask is “How does my budget plan stack up to others’ in Arizona?” We can help with this one. See below for Arizona Average cost of living (monthly) for a 2 person household. To see the graphic for a 4 person household, download the PDF version of the eBook.

Time to play with numbers! If you haven’t already, download our free budgeting template which coordinates nicely with everything we’ve discussed so far. Use it to plug in your numbers and see what happens if you take the $200 per month you spend on a gym membership and switch to a cheaper plan. That extra $150 per month could be a huge step in the right direction for a goal you have – such as saving for home improvements or paying down debt.

Where Should My Money Be Going?

If you don’t know what to prioritize in your budget plan, here are a few different goals to consider.

• Build Up a Buffer Fund

This is money that you leave in your checking account as extra. This is here in case you have multiple bills due at the same time early in the month and haven’t gotten your next paycheck yet. We’ve all been there! It’s especially helpful for those of us wanting to do Zero Balance Budgeting, because it takes some of the anxiety out of giving every single dollar a job. We recommend at least $500 as a buffer that just stays in the account.

• Leave Room for “Wants”

Don’t be too stingy with yourself. If you leave $0 for spending money, you’ll quickly get frustrated and give up on your budget. Leave room to treat yourself every month.

• Emergency Savings

Start with a goal of saving $500 for an emergency. Put it in a separate account! With our savings accounts, you can name them specifically for your goal. Just hit the pencil icon next to the account in online banking to give it a name. 28% of Americans have no emergency savings, so once you put your first $10 away, you’ll be ahead of almost 1/3 of the US. Shop around and find the best savings account to suit you, though right now very few of them are able to pay high dividends.

Already at $500? Bump up your goal to $1000. Next, shoot for 1 month’s expenses saved. When you’ve banked one month’s worth, start working on 3 months. The goal for most folks is that you’d be able to cover your expenses in an emergency for 3-6 months. But that’s a huge amount to think about, so take baby steps.

If this goal is something you’ve already accomplished (3-6 months’ worth of emergency funds) we often hear "Should I be investing this money somewhere?” Our answer is no. We want to keep these funds ‘liquid’ a.k.a. completely available in a moment’s notice instead of locked away in a long-term investment.

• Debt Payoff

Either focus on paying off high-interest debt first, or lowest balance debt first. Credit cards, retail loans, and lines of credit tend to have higher rates than car loans and mortgages. Make more than the minimum payment if you can, or simply make a fixed payment each month regardless of what the minimum is. What’s considered ‘high’ interest? An APR over 9-10%. We have tons of debt payoff resources on our website like this Debt Relief Bundle if you need more info.

• Specific Savings Goals

Putting money to work for big-ticket items such as vacations, big purchases, or future down payment on a home or car tends to be a wise long-term strategy. This prevents you from throwing those expenses on a credit card in the future. Perhaps setting money away for these expensive goals will allow you to plan a budget-friendly Arizona vacation!

• Retirement and Education

The earlier you start saving for retirement, the more money you'll have when you retire.

Some folks also like to think about their children or grandchildren and set up an education savings account that comes with tax benefits, like the Arizona 529 savings plan.

Chapter 8: Budget Plan Case Study – Rubio & Alice Greenspend

Rubio and Alice sat down and determined their financial 'why' and their goals.

Goal 1: Have $1000 set aside for an emergency in case something unexpected were to happen.

Goal 2: Take a Tahitian vacation in 5 years and not have to pay for it with a credit card.

Here's what their budget worksheet looked like before they made any adjustments:

While their income level of $5,000 per month is sustainable to meeting their expenses, they realized they had a few problem areas keeping them from reaching their goals.

Problem 1: They’re currently putting $0 per month into savings.

Problem 2: Negative cash flow of -$335 per month means that they’re relying on the use of credit cards and debt to make it from month to month.

With spending on fun & entertainment topping $1,350 per month and another $795 currently making minimum payments on loans, they realized how much extra cash they’d have if they cut down on spending and focused on debt payoff / savings. Discussing it at length with their financial coach, they settled on the following changes to help them meet their goals:

Goal 1: Have $1000 set aside for an emergency in case something unexpected were to happen.

Solution: Open a separate savings account named “Emergency Fund” with their credit union for free, and set up an automatic savings plan to move $100 per month from checking to savings (on payday!) They’ll reach their goal in only 10 months!

Goal 2: Take a Tahitian vacation in 5 years and not have to pay for it with a credit card.

Solution: Resolve the negative cash flow issue by looking for areas in their budget where they can save money. That extra money will go to debt payoff.

- Rubio and Alice were able to negotiate with their cell phone company and reduce the bill by $15 per month.

- By meal planning most days per week instead of choosing takeout/restaurants for lunch and dinner, Alice and Rubio were able to reduce spending by $450 .

- They found a way to carpool to work together 3 times per week, so they cut down fuel/transportation costs by $70 per month.

- They changed their utilities plan to a 'peak hours' plan and committed to all dishwasher/laundry/high energy usage to occur in non-peak hours. They also installed high efficiency shower heads and faucets to cut down on water usage. This saves them about $40 per month.

- With all of these changes, it freed up an extra $240 per month. $100 of that is going towards an emergency savings fund and the other $140 they decided to put towards their highest interest debt (credit card). When you add the $140 to the $150 they were already paying each month, that's $290 per month to the credit card, and it will be paid off in only 6 months! Then they'll have an extra $290 per month available to save up for vacation, or to keep chipping away at debt. Freedom! 😍

.gif?width=1100&name=$310%20(1).gif)

Want the budget worksheet Alice & Rubio used? Get it for free here:

Conclusion

As you can see, the idea of a Zero Balance Budget is to raise awareness about your current spending habits and steer your money into doing more productive jobs that lead you to reaching your financial goals. At the end of each month, every penny can be accounted for and your financial future should incrementally improve.

But if you need more help, not to worry. Our partners at GreenPath Financial Wellness have certified credit counselors that are happy to provide free, confidential counseling for anyone who needs help with a budget, feels overwhelmed by debt, or just can't make ends meet. Learn more about our partnership with GreenPath or simply request a call.

You work hard to earn a living. It’s about time that money starts working for you. And if you're not a member of Copper State Credit Union already, you should be! Click below to become a member.

.png?width=300&height=400&name=300x400%20ebook%20cover%20(2).png)

Download the free eBook now:

Sources:

https://www.businessinsider.com/personal-finance/zero-sum-budget

https://www.daveramsey.com/blog/how-to-make-a-zero-based-budget

https://www.nerdwallet.com/article/finance/zero-based-budgeting-explained

https://www.credit.com/blog/what-is-a-good-interest-rate-60455/#:~:text=According%20to%20the%20National%20Association,likely%20to%20be%20considered%20high.

https://www.bankrate.com/banking/savings/financial-security-june-2019/#:~:text=Nearly%20three%20in%2010%20(28,money%20is%20critical%2C%20experts%20say.

https://pubmed.ncbi.nlm.nih.gov/14998709/

https://www.daveramsey.com/blog/4-things-you-must-budget

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.